The ascent of digital technologies and online platforms has triggered a decline in the demand for conventional paper goods. Digital substitutes have gained traction for communication, advertising, and information sharing, reducing the reliance on paper-based materials. Added challenges facing the industry include the emergence of alternative materials, notably in packaging, which afford enhanced flexibility and durability, as well as escalating input costs, posing obstacles to producing competitively priced products. Nonetheless, despite these challenges, global shifts towards sustainability, customisation, and e-commerce have stimulated pockets of demand within the sector.

THE GLOBAL CORRUGATED PACKAGING MARKET

In 2023, the worldwide corrugated packaging market was valued at $285.94 billion, with projections indicating a compound annual growth rate (CAGR) of 4.1%, poised to surpass $410.5 billion by 2032. Surpassing earlier expectations, the global corrugated packaging market shows accelerated growth, defying forecasts of a slowdown in consumption. Anticipated declines in demand from China and restrictions on contaminated recycled paper stocks have not materialised to the extent predicted. Within the Corrugated and Containerboard Manufacturing (CCM) category, the food and beverages segment notably claimed the largest share, accounting for 22.38%.

Key Growth Drivers

Due to its stability, durability and versatility, corrugated fibreboard has become the preferred packaging choice in several industries. Key drivers of this demand include shifts to more environmentally friendly practices, growing pressure to curb costs, growth in e-commerce and retail printing.

Figure 1 Key Growth Drivers: Global Corrugated Packaging Industry

Paper Manufacturers Association of South Africa (PAMSA) ‘Trend Tracker Survey’ 2023

South Africa was one of 16 countries that participated in this year’s ‘Trend Tracker Survey,’ a biennial consumer research study aimed at understanding consumer preferences towards print and paper products. Notable results from the survey indicate that 58% of participants prefer products ordered online to be delivered in paper packaging, 56% are actively taking steps to increase their use of paper packaging, and 60% would buy more from retailers who remove plastic from their packaging. Overall, these trends show a clear shift away from multilayer plastic flexibles in favour of carton board and paper packaging.

THE GLOBAL UNCOATED PAPER MARKET

The uncoated paper market is projected to see steady growth of approximately 9% over the next decade. The Printing Paper segment, holding a 68% market share, dominates the market. The trend towards sustainable and cost-effective paper products positions uncoated groundwood paper as the preferred type, likely to dominate the industry throughout the forecast period.

Key Growth Drivers

Several factors are driving growth in the uncoated paper market, including increased demand in the education sector, a growing preference for eco-friendly packaging materials, a shift toward greater client customisation, and the expansion of the e-commerce industry.

Figure 2 Key Growth Drivers: Global Uncoated Paper Industry

Spotlight on South Africa’s publishing industry

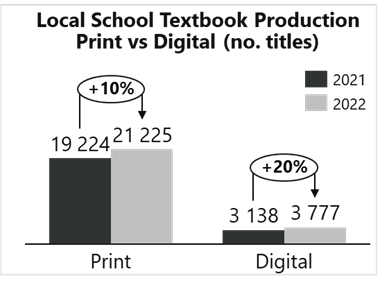

The transition to digital media is significantly affecting the publishing industry, leading to changes in the demand for paper products. In 2021/22, the South African publishing industry was valued at approximately R3.3 billion. The education sector is the largest sub-sector, accounting for 61% of total revenue. The rise of online learning and digital textbooks has driven the growth of digital publishing within this sector. Although print publishing still dominates, digital publishing is expanding at a faster pace, presenting a substantial challenge to traditional print formats .

LOCAL PAPER & PACKAGING INDUSTRY: KEY SUPPLY AND DEMAND TRENDS

Rising input costs are making it increasingly challenging for local companies to manufacture products cost-effectively. Meanwhile, technological advancements and the growing adoption of digital solutions are shifting demand away from paper-based products.

Supply-side Trends

Since 2012/2013, electricity costs have doubled, and water costs have tripled, significantly impacting utilities expenses. Labour unit costs have also risen sharply, increasing by 40 index points over the past decade, with a notable 14-point rise in just the last three years. Transport costs have surged due to a 33% increase in fuel prices between 2019 and 2023. Additionally, wood pulp prices are forecast to grow at a compound annual growth rate (CAGR) of 3.71%, maintaining a pace similar to that of the last decade. The sustainability agenda is also shaping the industry, as commitments to sustainable sourcing practices, circular economy principles, and net-zero ambitions have become essential necessities rather than optional ideals.

Demand-side Trends

Technological advancements and increased digital adoption are shifting demand for paper-based products. Particularly, the rise of e-commerce and courier services has significantly spurred the demand for various packaging solutions. South Africa’s packaging industry is expected to grow at a CAGR of 6%, primarily driven by the substantial growth of e-commerce, which has been averaging 20-35% annual growth since 2021. This surge in online sales has also boosted demand for the Courier, Express, and Parcel market, projected to grow at a CAGR of 7% by utilising a wide range of packaging solutions. Conversely, the demand for printing paper products is muted, with the local stationery market projected to experience modest growth at a CAGR of 3.4%, while the print newspapers and magazines market is expected to see negative growth at a CAGR of -0.86%, and the books market at -1.35%. Finally, shifting customer preferences towards sustainable and ‘greener’ packaging are also driving demand for paper and other recyclable materials.

CONCLUSION

In summary, the paper and packaging industry stands at a critical juncture, driven by innovative shifts in technology, emerging environmental demands and changing market requirements. While digitalisation has reduced the demand for traditional paper products, it has also ignited new opportunities for sustainable packaging and customised solutions. Despite rising production costs and emergence of substitute products, the push towards ecofriendly practices, exponential growth of e-commerce and growing consumer preferences for customisation are changing the industry landscape and presenting new opportunities.

The future is bright for companies prepared to innovate and embrace emerging global trends. Success relies on addressing both supply and demand factors. By optimising supply chain and production practices, companies can better combat rising costs. Industry players also need to reevaluate their market offerings to ensure a product mix that meets current and emerging demands. Innovation will be crucial not only for cost reduction but also in meeting the growing demand for customised and eco-friendly packaging solutions.

ABOUT LETSEMA

Letsema is a Black-owned boutique professional services firm at the heart of a diversified investment holding company. We offer a diverse set of capabilities to help companies identify and manage both demand and supply drivers to deliver short-term value and promote sustainable business operations. Our specialist practices provide comprehensive business support across a range of industries. Our commitment to leveraging business as a catalyst for positive social change underpins the work we do.

For further information about who we are and what we do please visit us at www.letsema.co.za.